- Below-average major losses in property-casualty reinsurance

- Impairment losses on Russian and Ukrainian bonds, first Russia/Ukraine claims

- April renewals yield further premium growth (+7.6%), prices continue to be at a high level

- Gross premium expected to increase to €64bn in 2022

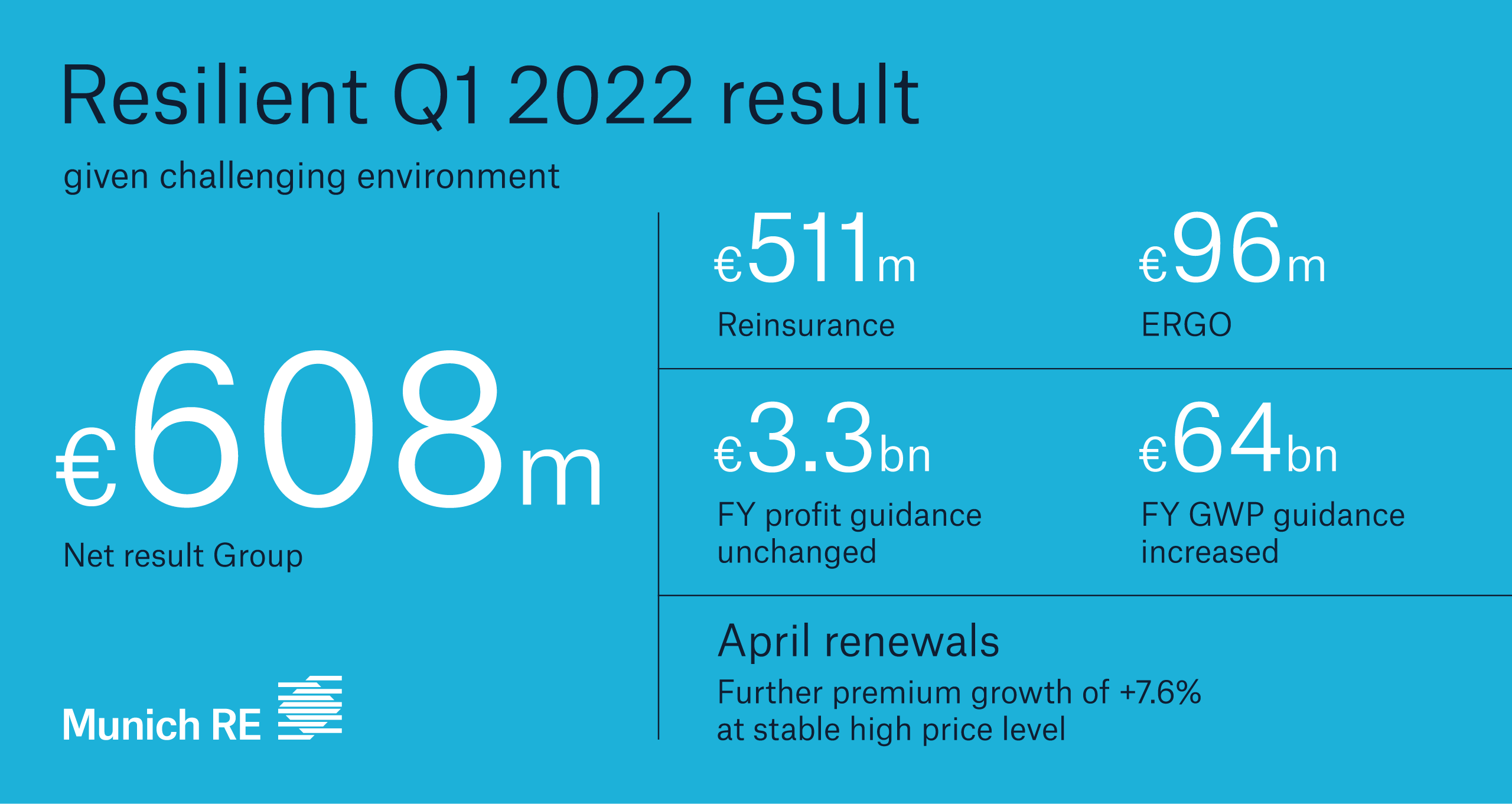

Munich Re is helping to provide humanitarian aid for the people of Ukraine and fully supports the sanctions against Russia. The financial consequences of the war and the sanctions severely impacted our result in the first quarter: We made write-downs for impairment losses on Russian and Ukrainian bonds alike and recorded the first claims. Despite the uncertainties of a challenging environment, Munich Re maintains its annual guidance of €3.3bn based on a quarterly profit of more than €600m.

Summary of Q1 figures

Munich Re generated a profit of €608m (589m) in Q1 2022. The operating result totalled €780m (798m), while the other non-operating result amounted to –€14m (– 12m). The currency result totalled €17m (–23m), and the effective tax rate was 17.6% (16.3%). Supported by strong organic growth across all segments, especially in property-casualty reinsurance, gross premiums written increased substantially by 15.7% year on year to €16,833 (14,551m).

At €27,783m, equity was down from the level at the start of the year (€30,945m), mainly due to a decline in valuation reserves on fixed-interest securities. The latter was attributable to a rise in interest rates that is economically advantageous for insurers. The solvency ratio was approx. 231% (227% as at 31 December 2021), which is above the optimum range (175–220%), and includes the deduction of €1bn share buy-back. Building on this strong capital base, Munich Re will redeem two subordinated bonds.

The annualised return on equity (RoE) for Q1 2022 was 9.8% (10.4%).

Reinsurance: Result of €511m

The reinsurance field of business contributed €511m (410m) to the consolidated result in Q1. The operating result rose to €654m (558m) and gross premiums written increased to €11,307m (9,389m).

Life and health reinsurance business generated a loss of €78m (+52m) in Q1, mainly due to COVID-19-related losses of €150m, above all from the Omicron wave in the USA. Premium income rose to €3,369m (3,058m). Business with non-significant risk transfer (fee income) continued to see very pleasing growth. At €20m (51m), the Q1 technical result (including the result from business with non-significant risk transfer) fell short of the pro-rated annual target due to pandemic losses, mainly expected in the first half of the year. Overall, the segment reported good operational performance in Q1.

Property-casualty reinsurance contributed €589m (358m) to the result in Q1. Premium volume increased substantially to €7,938m (6,330m), with a continued strong focus on quality. The combined ratio was 91.3% (98.9%) of net earned premium. In Q1, Munich Re posted expenditure related to the war in Ukraine of slightly over €100m in some specialty lines.

Major losses of over €10m each totalled €667m (892m). This figure includes gains from the settlement of major losses from previous years of around €100m. Major-loss expenditure corresponded to 9.2% (15.5%) of net earned premiums, and was thus below the long-term average expected value of 13%. Man-made major losses declined to €185m (247m). Major losses from natural catastrophes came to €481m (646m) in Q1. Major natural catastrophe events included heavy rainfall in eastern Australia, resulting in losses of around €440m, and the winter storms in Europe, which produced losses of slightly below €120m for Munich Re.

In Q1, loss reserves of €291m (230m) were released for basic losses from prior years, which corresponds to 4.0% (4.0%) of net earned premiums. The normalised combined ratio was 94.8%. Munich Re continually seeks to set the amount of provisions for newly emerging claims at the very top end of the estimation range so that profits from the release of a portion of these reserves can be generated at a later stage.

In the reinsurance renewals as at 1 April 2022, Munich Re was able to increase the volume of business written to €2.7bn (+7.6%). It was possible to tap into growth opportunities, especially in Asia – particularly in Japan and India – as well as in Latin America. By contrast, Munich Re once again selectively discontinued business that no longer met risk/return expectations.

Prices were up overall in the sectional markets, with significantly different trends dependent upon claims experience, future loss expectations and the situation in each individual market. Prices for reinsurance cover rose considerably in some markets, including the USA.

All in all, prices for the Munich Re portfolio continued to be at a high level (–0.1%). This figure is, as always, risk-adjusted. In other words, price increases are offset if they are associated with increased risk and, consequently, elevated loss expectations. Particularly in light of higher inflation, Munich Re was deliberately cautious in calculating future loss expectations.

Munich Re anticipates that the market environment will remain stable in the next renewal round in July, offering attractive growth opportunities.

ERGO: Result of €96m

Despite adverse effects from volatile capital markets and major losses, ERGO posted a profit of €96m (178m) for Munich Re in Q1 thanks to ongoing very pleasing operating performance across all segments. ERGO again saw substantial growth in Q1. Overall premium income rose to €5,803m (5,362m) supported by all segments, while gross premiums written increased to €5,526m (5,163m). The Property-casualty Germany segment saw particularly strong premium growth.

The ERGO Life and Health Germany segment contributed €44m (94m) to the result owing to a comparatively low investment result. In addition, loss development in health and travel business returned to normal after a very good Q1 2021. Driven by continued excellent operating performance, the ERGO International segment posted a good result of €40m after generating a high profit (€60m) in the same quarter last year. The ERGO Property-casualty Germany segment posted a profit of €12m (24m). Major-loss expenditure was partly offset by profitable premium growth and a good investment result. The operating result for the ERGO field of business amounted to €127m (240m).

In the Property-casualty Germany segment, the combined ratio was 97.4% (94.2%). This development was driven by major losses as well as normal seasonal fluctuations in premiums and claims. In the International segment, the combined ratio improved to 92.6% (93.8%) thanks to ongoing excellent development in our core markets, especially Poland and Greece.

Investments: Investment result of €987m

Munich Re’s investment result decreased to €987m (1,691m) in Q1. Regular income from investments was up slightly to €1,458m (1,429m). The balance of gains and losses on disposals excluding derivatives amounted to €960m (983m). The net balance of derivatives amounted to –€116m (–368m). The net balance of write-ups and write-downs declined substantially to –€1,122m (–171m), mainly due to gross write-downs of almost €700m (net: €370m) on Russian and Ukrainian bonds, which impacted the investment results of both reinsurance and ERGO.

Overall, the Q1 investment result represents a return of 1.6% on the average market value of the portfolio. The running yield was 2.3% and the yield on reinvestment rose substantially to 2.1%. The equity-backing ratio including equity derivatives amounted to 7.5% as at 31 March 2022 (7.7% as at 31 December 2021).

The investment portfolio as at 31 March 2022 decreased compared with the 2021 year-end figure, with the carrying amount falling to €233,308m (240,300m); the market values amounted to €245,860m (257,485m). This development was essentially due to the rise in interest rates.

Outlook for 2022: Annual target unchanged at €3.3bn

Munich Re expects to see advantageous business prospects in reinsurance in 2022. This is evident in the projected gross premium in this field of business, which has been adjusted upwards from €42.5bn to €45bn and, in turn, raises the forecast for the Munich Re Group as a whole to €64bn. The other targets communicated for 2022 in Munich Re’s Group Annual Report 2021 remain unchanged. Munich Re is still aiming for a consolidated result of €3.3bn for the 2022 financial year. The achievement of this result target is supported by a remaining major-loss budget in property-casualty reinsurance of around €3.3bn for the rest of the year.

All forecasts and targets face considerable uncertainty owing to fragile macroeconomic developments, volatile capital markets and the unclear future of the pandemic. In particular, there is considerable uncertainty regarding the financial impact of the Russian war of aggression in Ukraine. As always, the projections are subject to major losses being within normal bounds, and to the income statement not being impacted by severe fluctuations in the currency or capital markets, significant changes in the tax environment, or other one-off effects.